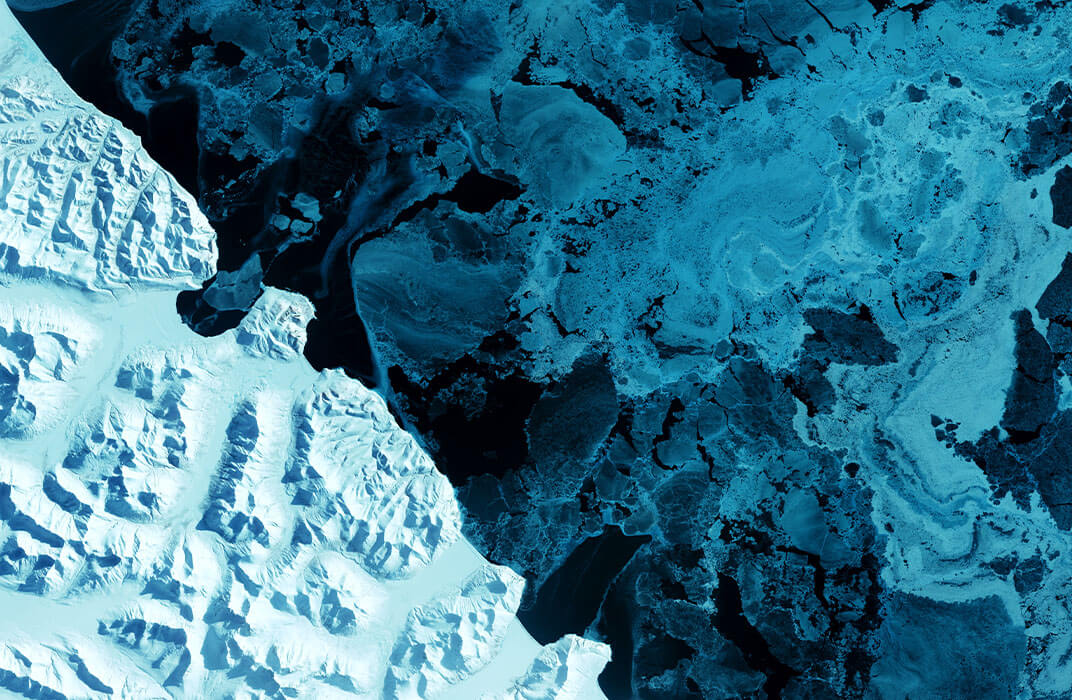

Our Culture

Culture defines how our people collaborate: embracing continual innovation, analytical rigor, and cognitive diversity. It is a set of shared beliefs, anchored by objectivity and research-driven, where intellectual curiosity meets empirical standards and competence meets humility in the empowerment to question each other as well as the data.