China A-Shares: Welcome to the Emerging Markets Index

Key Takeaways

- MSCI will include China A-shares in its Emerging Markets Index beginning in June 2018. The initial weight within the index will be limited, but we anticipate it will expand materially in the coming years.

- Improvements in market access and operational aspects of trading China A-shares led MSCI to upgrade this vast market.

- The breadth and diversity of the China A-shares market, along with its inherent inefficiencies, present a unique opportunity for disciplined, systematic investors.

Table of contents

From Acadian Investment Team

May 2018

Introduction

Beginning in June 2018, MSCI will include China A-shares, a market previously only available to onshore Chinese investors, in its Emerging Markets Index. This addition is a landmark event as it will increase foreign investment in China A-shares and presents a broader, more diversified set of investment opportunities than currently available through China’s offshore-listed companies. MSCI plans to include 234 China A large-cap securities in the MSCI Emerging Markets Index via a two-step inclusion process that will coincide with the May 2018 Semi-Annual Index Review and the August 2018 Quarterly Index Review. The selected securities will be accessible to investors through the Hong Kong Stock Connect platform and must pass various vetting criteria. As of the June inclusion, A-shares will comprise 0.39% of the Emerging Markets Index’s weight. As of August, this will increase to 0.78%. In coming years, however, full inclusion of China A-shares in the Emerging Markets Index has the potential to increase China’s weight to nearly 50%.1

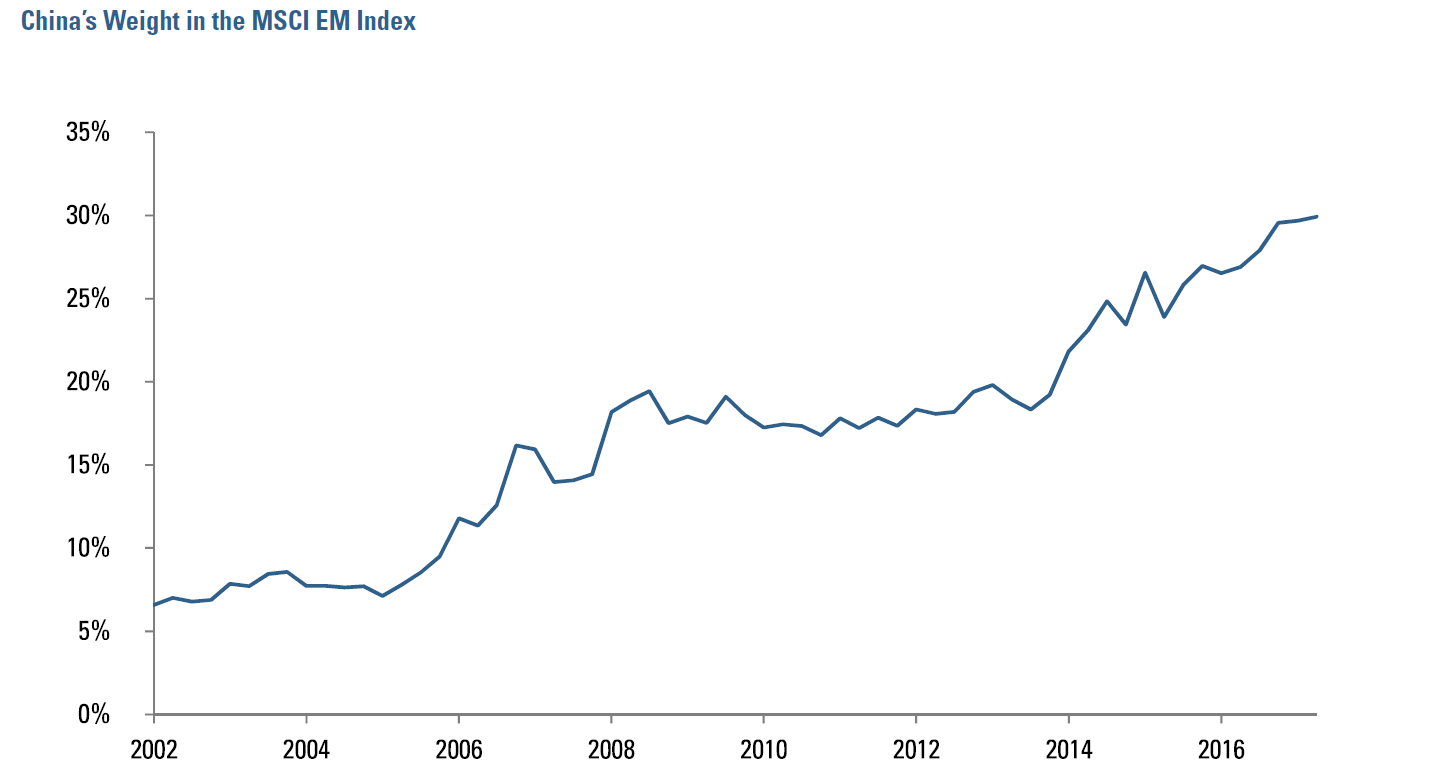

A-Shares: The Path To Inclusion

MSCI initially included Chinese B-shares in its Emerging Markets Index in September 1996 at a weight of 0.46%. This weight remained reasonably stable until 2000 when MSCI added Hong Kong-traded Chinese equities (e.g., Red Chips, H-Shares), raising China’s index representation above 5%. Figure 1 showcases the weight of China in the MSCI Emerging Markets Index from 2002 through March 2018. Today, prior to the inclusion of onshore A-shares, China comprises close to 30% of this Index.

Figure 1

The path to A-shares’ promotion to MSCI’s EM index has been more complicated. When added to the inclusion watch list in 2013, the A-shares market met MSCI’s index criteria for both size and liquidity, but it was denied based on the market’s accessibility to global institutional investors as well as operational concerns.

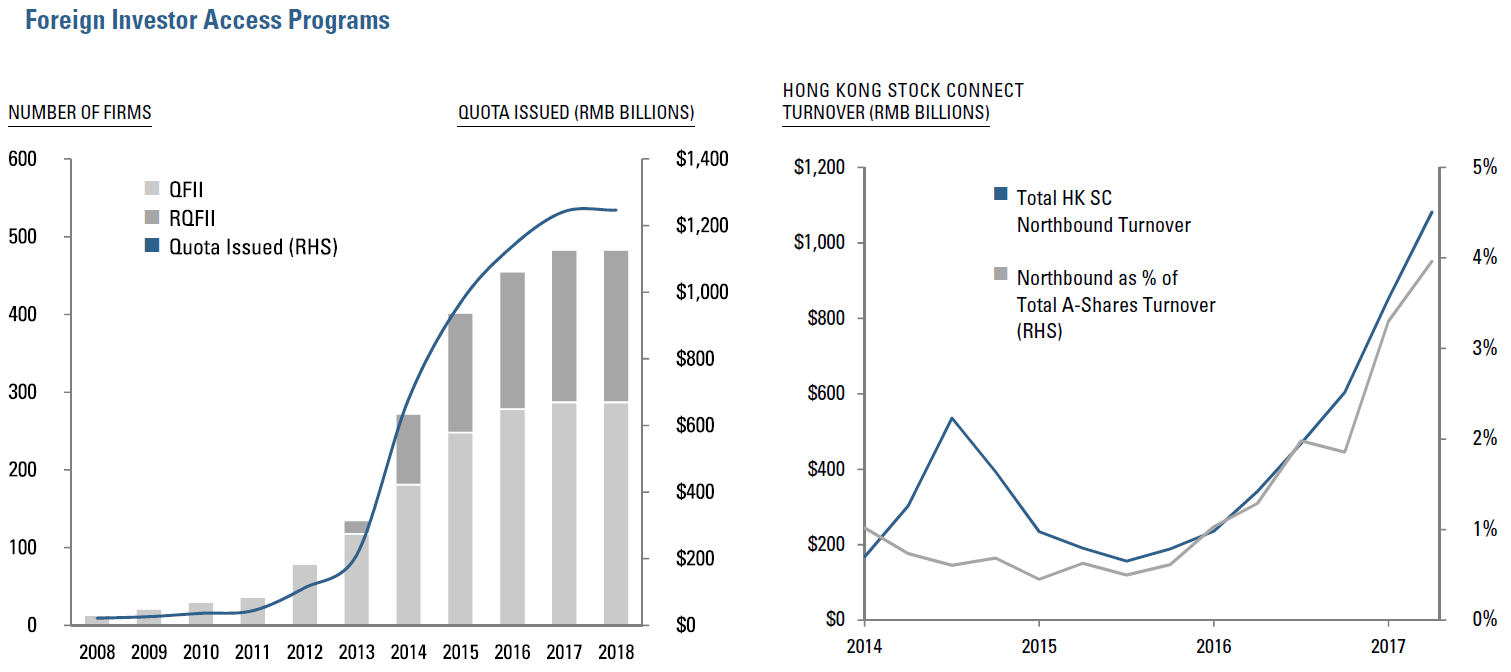

In the years since, foreign access to the onshore market has expanded via the Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII), and two Stock Connect programs: Shanghai (SSE)-Hong Kong Stock Connect and Shenzhen (SZSE)-Hong Kong Stock Connect. These programs are essentially digital pipelines connecting the Hong Kong Stock Exchange to either the SSE or SZSE with trades being directed north from Hong Kong. The QFII and RQFII licenses, obtained through the China Securities Regulatory Commission (CSRC), enable eligible investors to access the A-shares market, subject to quotas on holdings.2 Figure 2 illustrates the growth of the QFII, RQFII, and Hong Kong Stock Connect programs.

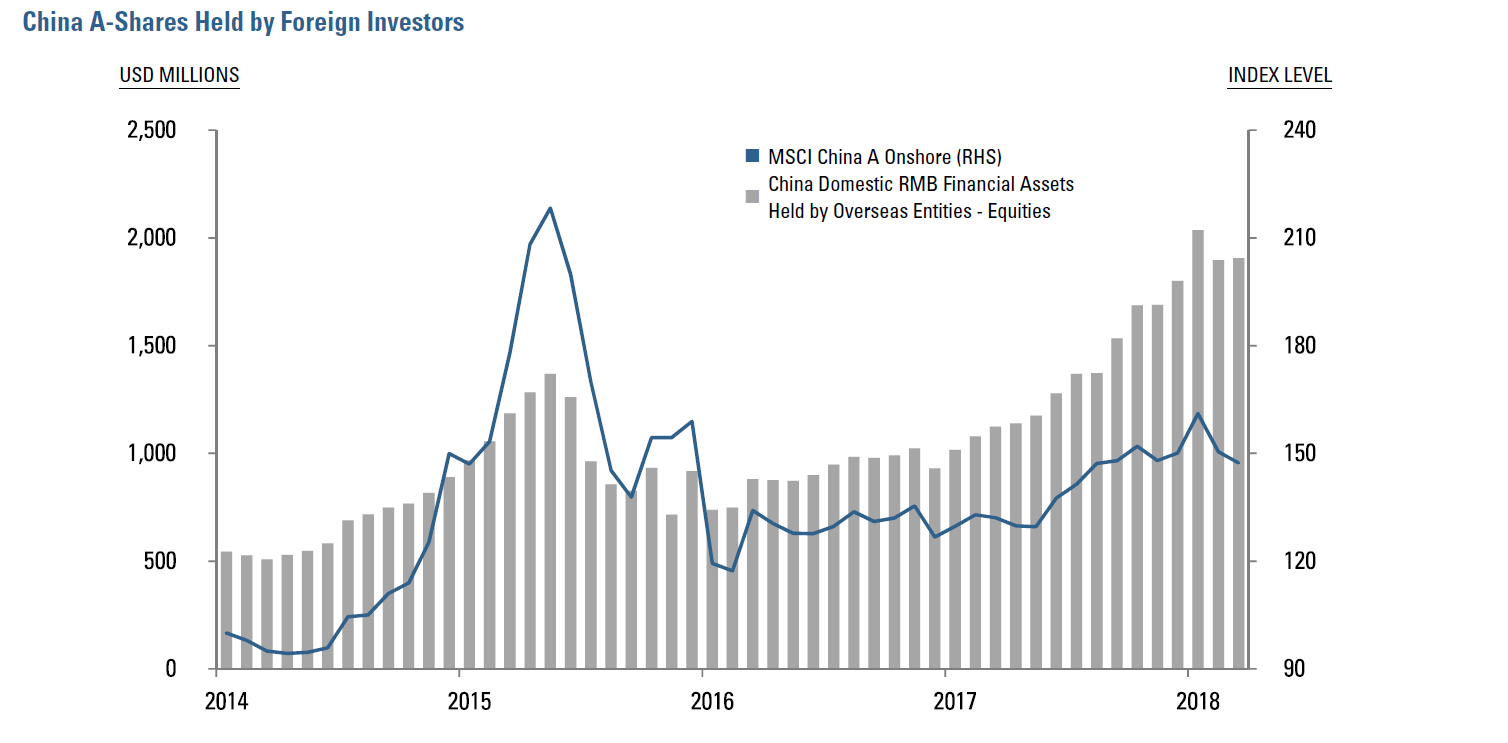

These access programs have changed the landscape of China’s equity market. Figure 3 shows that China A-share holdings by non-Chinese investors have increased 250% since 2014, when the People’s Bank of China first published the data.3

Figure 2

Figure 3

Operational Considerations

China also implemented reforms to address operational hurdles and align its practices with global markets. In 2013, Chinese officials relaxed repatriation rules and simplified cash management for foreign investors. Capital controls have been loosened, although both index providers and investors would like further easing. Guidelines for quota allocations have become less limiting, a change well received by MSCI. SSE and SZSE have increased transparency and standardization of rules related to stock suspensions, reducing their frequency and duration. Guidance issued on beneficial ownership status has expanded the scope and ease by which foreign investors can claim favorable tax treatment on Chinese sourced dividend income. China has also adopted less restrictive pre-approval requirements for the creation of index-related investment vehicles. While there is still room for operational improvements, e.g., the T+0 settlement cycle and the 10% daily price circuit breaker, progress has been material.

In June 2017, in recognition of access and operational developments, MSCI announced that it would partially include A-shares into the EM index, effective 2018. MSCI continues to monitor improvements and has signaled that increased inclusion of A-Shares would be conditional upon further progress. Specific areas of focus include a continued decline in suspensions and further loosening of pre-approval requirements for index-linked vehicles. MSCI is also looking to see how investors utilize Stock Connect and whether the market further aligns with international access standards.

Impact of Inclusion

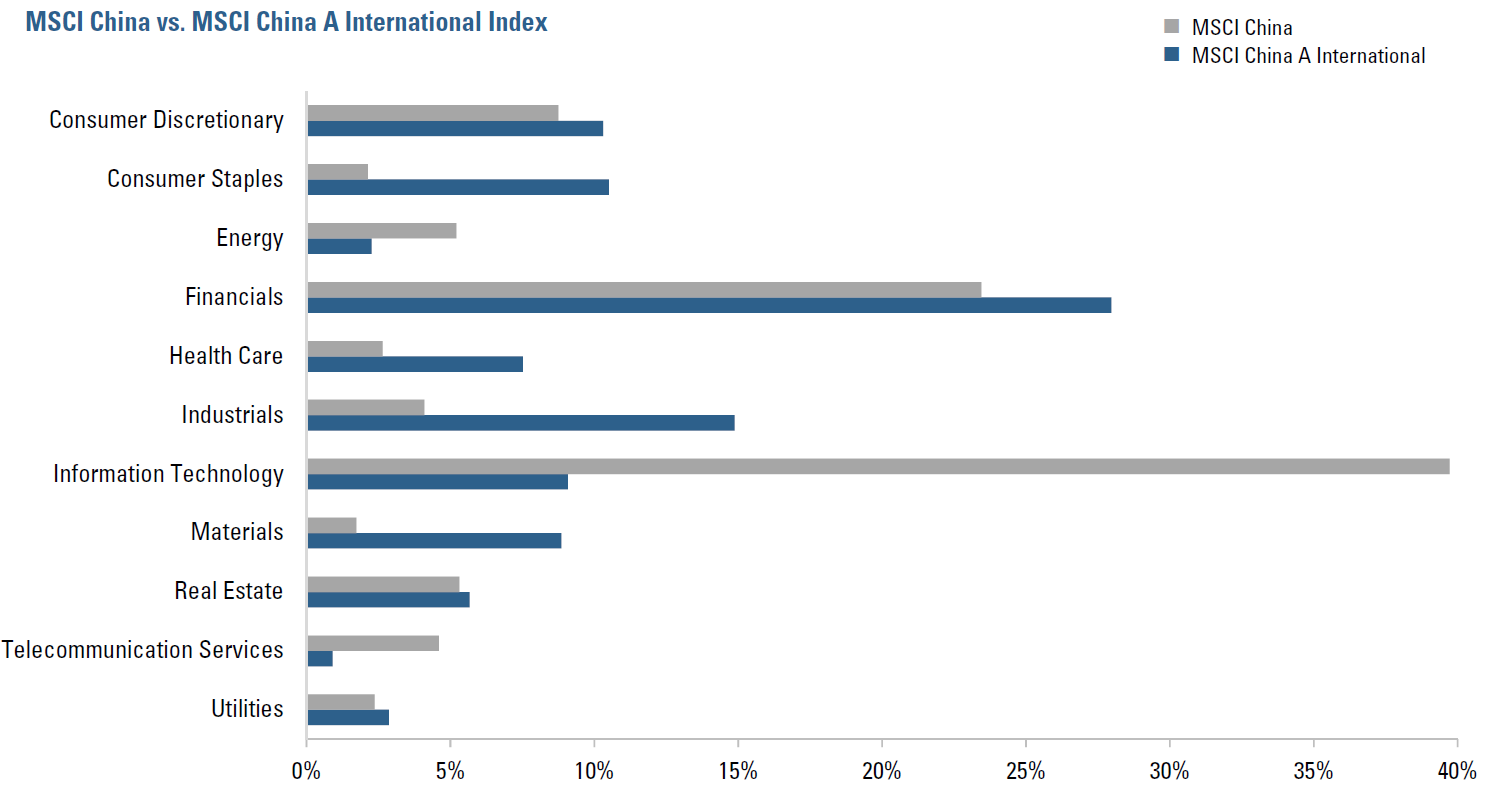

Inclusion of China A-shares will broaden and diversify MSCI Emerging Markets Index exposure across Chinese industries, as the local markets offer greater opportunity for investment in consumer-driven sectors, including healthcare and consumer staples (see Figure 4). A shares also tend to have cheaper valuations, smaller market capitalizations, higher volatilities, and lower betas to the existing MSCI EM index (pre-A shares inclusion). Drivers of A-share returns have also differed, more heavily influenced by growth factors and less so by quality. These unique characteristics suggest the need for a tailored approach to A-shares investing.

We expect significant allocations to China over the coming years given China’s growing weight in the index. Currently, $384 billion of passive capital and $1.3 trillion of active capital tracks the MSCI Emerging Markets Index.4 As China’s weight increases, we expect 1) rotation of passive capital into the onshore market and 2) that active managers will increase their exposure. Our prior research on index reclassifications suggests that countries transitioning from lower-demand indices to higher-demand indices face net buying pressure prior to the effective date of index inclusion.5 All of this leads us to believe that an overweight position in China A-shares is compelling given market inefficiencies and opportunity for stock selection.

Figure 4

The MSCI China A International Index captures large and mid-cap representation and includes the China A-share constituents of the MSCI China All Shares Index. It is based on the concept of the integrated MSCI China equity universe with China A-shares included.

Source: Copyright MSCI 2018. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI. For illustrative purposes only.

Considerations As China A-Shares Are Further Included

Given China A-shares’ limited initial weighting, the addition event won’t materially change MSCI EM Index composition this year. However, we expect China A’s weighting within the index to grow materially over time. MSCI has indicated that full integration would increase China’s overall EM Index weight from roughly 30% to approximately 42%. Its weight in MSCI’s All-Country World Index would rise from roughly 4% to approximately 7%.

While MSCI has not provided guidance as to timing of further A-shares integration, precedent suggests that full inclusion could occur within 3 to 7 years.6 According to MSCI, further inclusion is contingent upon China granting market access consistent with international standards, as discussed above. Chinese officials understand this and continue to advance market reform initiatives. This April, regulators quadrupled the trade quota allowed through the Hong Kong Stock Connect program, and the country recently opened a Chinese Depository Receipt (CDR) market. The CDR will allow onshore Chinese to invest in companies that trade partially or exclusively offshore (e.g., Alibaba). This should disincentivize companies from listing their shares offshore in the first place and, in the long-term, may be the catalyst for numerous foreign-listed Chinese companies to ‘come home’ and primarily list their shares on the SSE or SZSE. Progress with respect to market liberalizations and reforms could accelerate the MSCI inclusion timetable.

Conclusion

The inclusion of the China A-shares market in the MSCI Emerging Markets Index, while modest in its initial scope, is a milestone event that acknowledges the wide-ranging market reforms implemented by the Chinese government. The market offers exposure to a broad and diversified set of investment opportunities not readily accessible to foreign investors previously. Furthermore, MSCI’s introduction of China A-shares into their indices stands to considerably influence index composition going forward, as its weighting increases to reflect A-shares’ economic significance. Although hurdles to full integration remain, we expect China A-shares to become increasingly important to emerging markets investors around the globe as the market becomes an even more prominent component of widely followed benchmarks.

Endnotes

- Copyright MSCI 2018. All Rights Reserved. Unpublished. PROPRIETARY TO MSCI.

- The QFII / RQFII application processes are documentation heavy and can take several months to over a year to complete. Licensed investors are subject to a quota, which is allocated by the State Administration of Foreign Exchange (SAFE) and takes approximately 3 to 5 months to be granted.

- Even with this growth, foreigners today still represent a small portion of the overall market at approximately 2%.

- “Counting Down, MSCI China A Shares Inclusion.” MSCI. May 2018. Figure represents MSCI EM-benchmarked assets; does not include EM allocations within MSCI All-Country World. Data as of June 30, 2017, as reported by eVestment, Morningstar, and Bloomberg.

- “Transition Strategies Around MSCI Country Reclassifications.” Acadian Asset Management. December 2015.

- Korea and Taiwan were both included in the MSCI index in tranches in the 1990s. Korea was included in the index in 1992 and achieved full inclusion 6 years later in 1998. Taiwan was initially added in 1996 and reached full inclusion in 2004.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.