Thinking Broadly: Improving Active Performance Via Systematic Extensions

Key Takeaways

- Systematic extension strategies are an underappreciated and underutilized tool for asset owners seeking higher active returns.

- Relaxing the long-only constraint permits broader, deeper, and more precise exposure to the richest parts of the active opportunity set and, potentially, greater flexibility in risk control.

- Relative to trendier methods of increasing active exposure, systematic extensions provide a more disciplined approach to high conviction active investing.

Table of contents

Shifts in the investing climate over recent years have prompted asset owners to seek sources of higher active returns. When interest rates fell to historic lows, investors that were tasked with meeting traditional absolute return targets came under pressure to meet objectives that had become increasingly stretched in real terms. Then, in 2022, the sharp equity market selloff generated a surge of interest in investments that would be uncorrelated with broad market performance.

In the pursuit of higher active returns, a central challenge facing asset owners is to distinguish solutions that improve risk-adjusted performance from those that simply amplify active risk. Concentrated equity strategies offer a case in point. They became trendy over the past decade even though, or perhaps because, they generate substantially higher returns dispersion, due to limited flexibility in risk control and foregone diversification, that helps to draw attention to conspicuous “winners.”

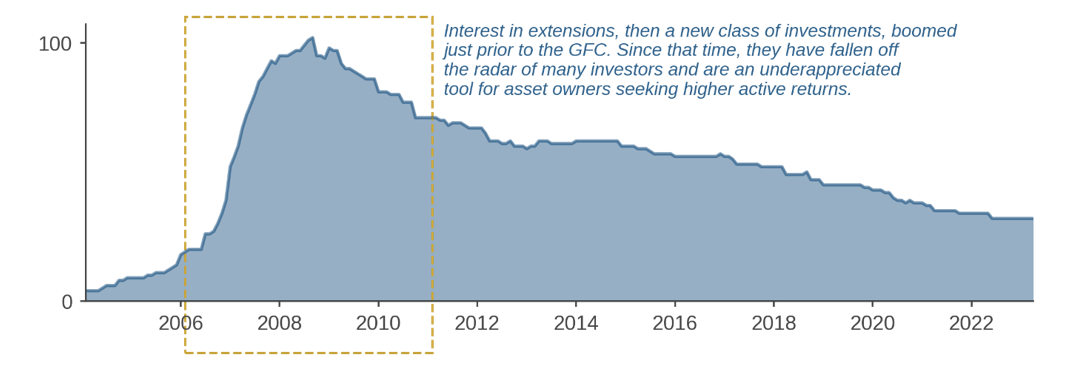

In contrast, systematic extension strategies offer a disciplined method of boosting active exposure. But they have been underutilized for years (Figure 1) due to hazy perceptions of their underperformance around the Global Financial Crisis (GFC) and a blurry leeriness of risks associated with shorting.

Figure 1: Extension Strategies—An Underappreciated Tool

In this note, we re-underwrite the practical benefits of systematic extensions and contrast their conceptually sound premise with that of concentrated equity strategies. We then provide a mini-case study of a hypothetical 130-30 strategy to demonstrate how extensions can improve performance by more precisely and more deeply exploiting the full active opportunity set and to clarify their risk profile.

Compelling Logic

Extension strategies are a form of high conviction investing. Compared to a long-only portfolio, they substantially increase exposure to a manager’s active views while keeping the underlying capital invested and market exposure roughly unchanged.

Extensions have special appeal in a systematic investing context, because they can be viewed as the product of a modest change in portfolio construction, often described as relaxing the long-only constraint.1 This modification has material benefits, because it allows for broader, deeper, and more precise exploitation of the active opportunity set.

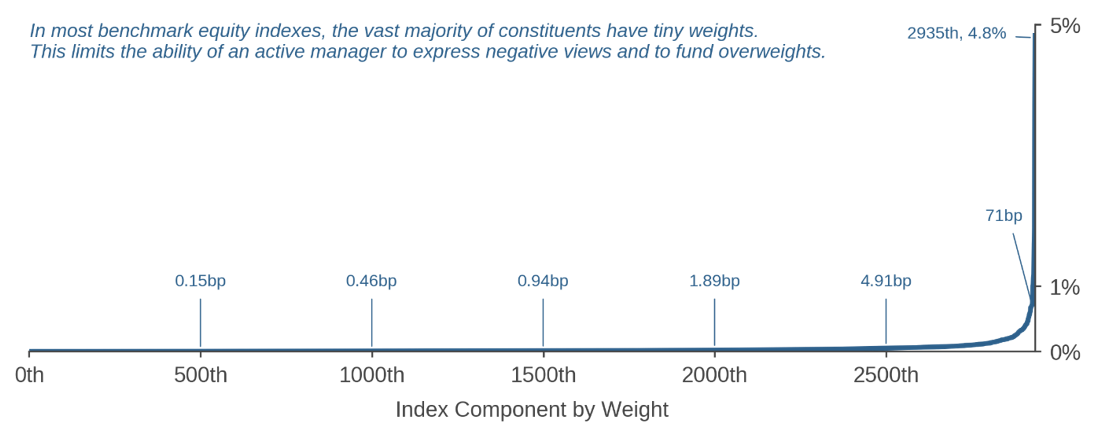

These benefits derive most prominently from two sources. First, extensions provide the manager much greater freedom to monetize views on stocks that it believes will underperform. In long-only contexts, the manager has no means whatsoever to underweight stocks outside the benchmark and only limited room to underweight most index constituents, because all but a handful have tiny weights. (See Figure 2, for example.) By allowing shorting, therefore, extensions greatly expand the set of usable forecasts and also increase flexibility to “fund” active longs.

Figure 2: MSCI ACWI Index Weights

As of June 30, 2023

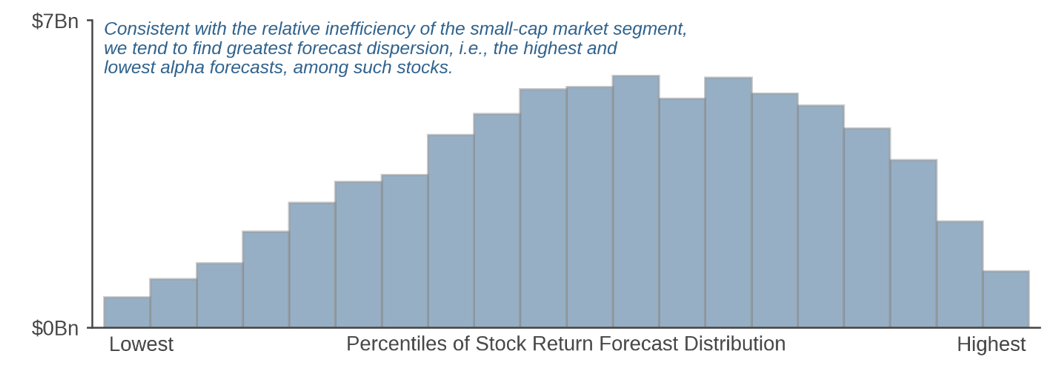

A second benefit of systematic extensions is that they afford increased flexibility to control risk that permits greater access to the rich active opportunity set available in smaller-cap stocks. The small-cap market segment is less efficiently priced because it has a poorer information environment and is harder to trade. Consequently, we find greater dispersion of returns forecasts in that market segment. (Figure 3) In a long-only context, leaning into the most attractive forecasts therefore entails exposure to a small-cap risk factor. Relaxing the long-only constraint helps to reduce this tension by allowing size risk from incremental small-cap longs to be offset by size risk from small-cap shorts. This increased flexibility to control risk while pursuing alpha applies not only to market capitalization, but to other uncompensated exposures, like currencies, countries, and industries, as well.

Figure 3: The Active Opportunity Set—Richer among Small-Cap Stocks

Average market capitalization across percentiles of Acadian stock return forecasts

Premises Contrasted: Through the Lens of the “FLAM”

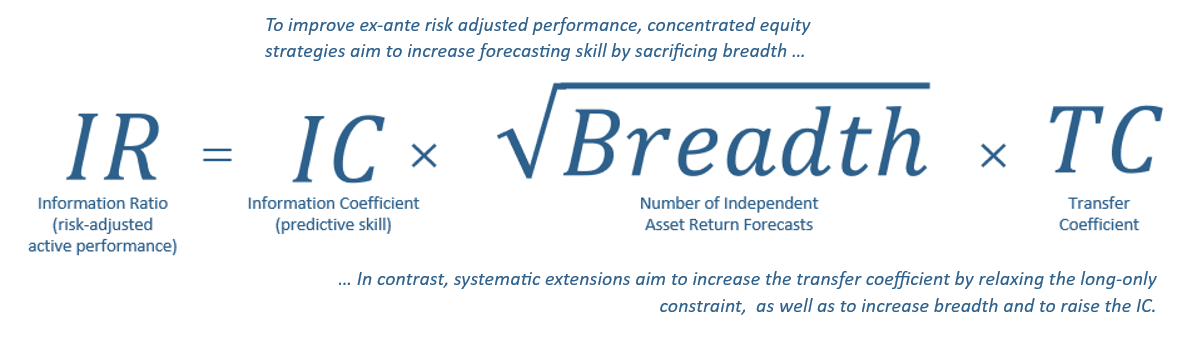

The Fundamental Law of Active Management (FLAM) provides a conceptual frame in which to compare the premise of systematic extensions with other methods of increasing active exposure, including a trendy approach, allocating to concentrated equity strategies.

The FLAM tells us that the ex-ante expected risk-adjusted active return of a portfolio depends on three things: the manager’s skill, the number of independent asset return forecasts that the manager expresses in the portfolio, and something known as the transfer coefficient. (Figure 4) The transfer coefficient, while perhaps an unfamiliar term to many investors, formalizes an intuitive concept: the manager’s ability to align active positions in the portfolio with its stock return predictions. Constraints on portfolio construction inhibit this ability and reduce the transfer coefficient (as do implementation frictions).2

Figure 4: The Fundamental Law of Active Management

As discussed above, the long-only constraint represents a consequential restriction on portfolio construction, and the FLAM helps to crystallize how its relaxation can increase ex-ante risk-adjusted active performance. Permitting shorting increases the transfer coefficient by allowing both broader and deeper negative active exposure to stocks with the lowest alphas and greater positive exposure to stocks with the highest. It improves breadth by increasing the number of independent forecasts incorporated into a portfolio, most apparently through the addition of the short side, i.e., monetization of views on underperformance.3 It can also increase the information coefficient, by improving access to the smaller-cap, less-efficiently priced market segment, where payoffs to alpha are higher.

Crucially, under the assumption that the manager already predicts both over and underperformance across a broad investment universe, then the modification to portfolio construction should require no changes to the forecasting process or to the universe of stocks to which it is applied. In the context of a systematic investing approach, this assumption is quite reasonable, because the entire investment process is expressly designed to scale.

In contrast, we view the conceptual foundation of a trendier method of embracing high conviction, investing in concentrated discretionary equity strategies, as murkier. Through the lens of the FLAM, concentration seeks to improve risk-adjusted performance by reducing the scope of a manager’s forecasting activities in order to increase predictive accuracy. That premise reflects an implicit assumption that the manager’s forecasting process does not scale well. That limitation is much more relevant to a traditional stock picker who has limited time and attention to consistently evaluate a broad opportunity set and to manage associated positions rather than to a systematic manager.

In the discretionary context, whether this trade-off of breadth for skill improves even ex-ante expected performance is hardly sure. It depends on whether the increase in expected active return more than compensates for an almost certain increase in active risk associated with both reduced flexibility to control systematic exposures and sacrifice of diversification.

A Hypothetical Case Study

Despite their logical premise, the marketplace for extension strategies dwindled after the GFC. Immediately following an initial boom in popularity in 2006 and 2007, what was then a new class of equity investments delivered underwhelming performance, causes of which we address below, and for years the approach fell out of favor with asset owners and consultants. Nearly a generation later, many investors have simply forgotten about extensions, while some may harbor lingering concern that there might be disproportionate risk associated with the short side of the portfolio.

As a refresher on extensions and to help clarify their risk profile, we present a mini-case study that compares three hypothetical active global strategies associated with the same initial capital outlay: First, a baseline global long-only active portfolio. Second, a levered baseline generated simply by scaling up the unlevered strategy’s returns by 1.6x.4 Third, a 130-30 extension strategy that shares the baseline’s investment universe, forecasts, and general portfolio construction framework.5

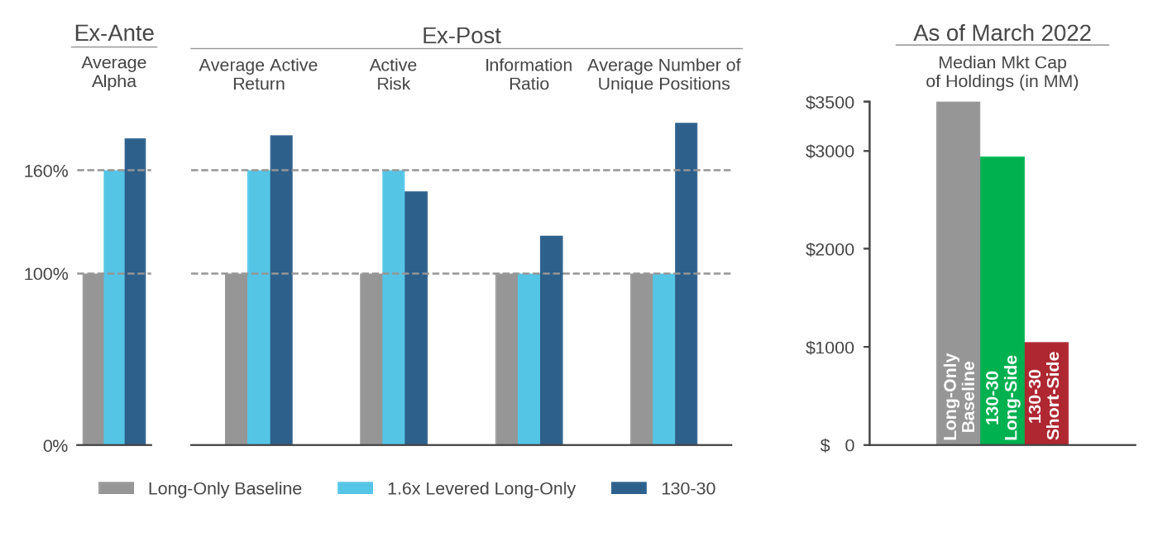

Figure 5 presents high-level results generated over a roughly 15-year sample period, from February 2007 through March 2022. The left chart shows that that the 130-30 strategy delivers higher ex-ante alpha than the 160% levered long (net of estimated transaction costs). In other words, the extension succeeds in delivering high conviction by amplifying alpha exposure to more than 1.6x the unlevered baseline.

Figure 5: Performance Summary—Hypothetical Global 130-30 Strategy and Long-Only Baselines

Sample period: February 2007 – March 2022

The chart also shows an increase in the ex-post IR (by roughly 20%). The higher risk-adjusted return derives from improvements in both the numerator and the denominator relative to what we would anticipate from levering up the long-only baseline, i.e., higher average active return and lower volatility.

Consistent with the intuition described in the prior section, Figure 5 also provides direct evidence connecting the increase in ex-ante alpha to both increased breadth and better exploitation of the less-efficient small-cap market segment. The average number of unique positions in the portfolio increases substantially. The median market cap of long-side holdings, as of March 2023, decreases by about 17%, from $3.5 billion to $2.9 billion. The median market cap on the short side is quite small, a little over $1.0 billion.

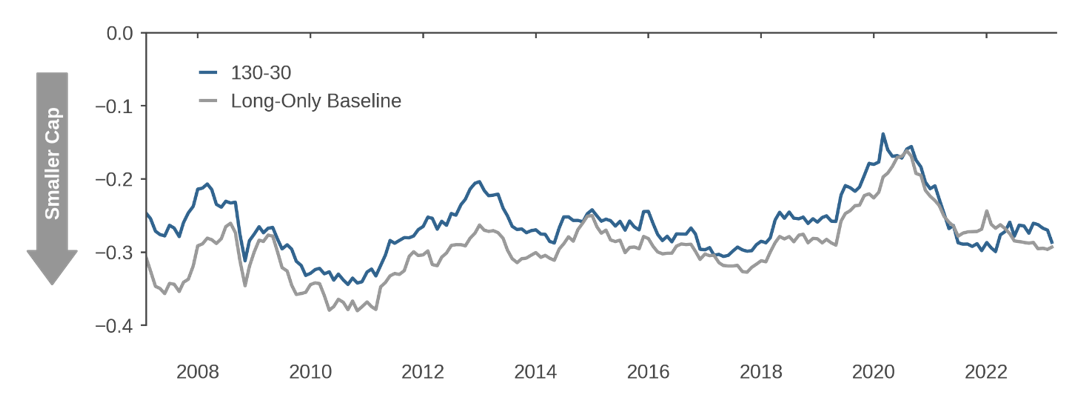

But as Figure 6 documents, the extension does not have greater small-cap risk exposure than the long-only baseline. In fact, despite deeper penetration of the smaller-cap segment, the net size risk exposure of the extension strategy is, on average, lower than that of the baseline. This is a clear demonstration of the flexibility to hedge incremental attractive small-cap longs with attractive small-cap shorts, or, equally validly, the ability to hedge attractive small-cap shorts with attractive small-cap longs.6

Figure 6: Size Risk Factor Exposure—Hypothetical Global 130-30 Strategy and Long-Only Baseline

It might even come as a surprise that the long-short extension strategy does not decrease size exposure more than it does. But the 130-30 portfolio is still 100% long rather than market neutral, and access to the opportunity set in small caps is valuable, so the strategy still utilizes its size exposure budget. That outcome reflects the particular parameterization of the size constraint in this exercise: we apply the same limit to the long-short portfolio that we do to the unlevered baseline, and we allow the extension to make greater use of that size-risk budget in pursuit of higher ex-ante alpha. In concept, an alternative implementation of the extension could tighten the constraint on size (or other exposures of concern to a particular investor) while aiming to keep total ex-ante alpha unchanged relative to the baseline. In our experience, however, the vast majority of extension investors prioritize increasing active returns.

Risk: Clarifying Perspective

Although in a conventional systematic 130-30 implementation net market beta remains close to one, the distinctive features of extension strategies, including amplification of alpha exposure and introduction of the short side, have the potential to alter their risk profiles relative to otherwise comparable long-only portfolios.

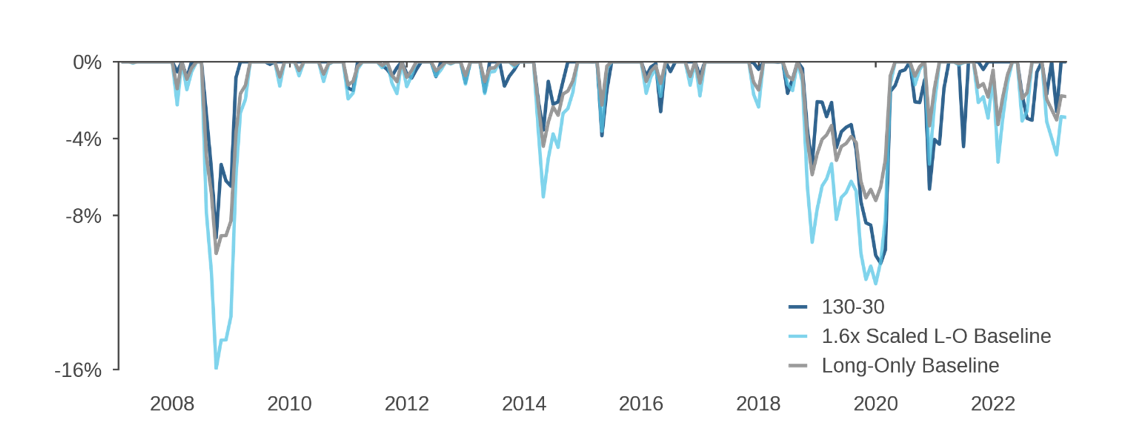

To help clarify potential vulnerabilities of extensions, Figure 7 compares active drawdowns across the three hypothetical portfolios from the case study. The 130-30 implementation experiences few episodes where underperformance exceeds that of the 1.6x levered long-only. In fact, underperformance is often more limited, similar to the unlevered baseline, including during the aftermath of the GFC. We can build intuition for this encouraging behavior by separately considering two possible drivers of underperformance, 1) a breakdown in alpha forecasting efficacy and 2) a shock to an (uncompensated) risk factor.7

Figure 7: Active Drawdowns—Hypothetical Global 130-30 Strategy and Long-Only Baselines

In the former case, the 1.6x-levered baseline provides a loose anchor for our expectations of 130-30 active performance, since both of these portfolios have similarly amplified exposure to the alpha model. To the extent that the extension implementation succeeds in producing even more than 1.6x the ex-ante alpha, we would expect it to have proportionately greater sensitivity to a breakdown in realized forecast efficacy. But we can reasonably view such risk as a feature of an extension—the very definition of achieving “high conviction”—rather than a bug.

What gives some investors pause, however, is concern that the short side of the extension portfolio creates risk of disproportionate loss (relative to the overall amplification of exposure to the alpha model). An archetypal example would be a “momentum crash” where trend-based signals are whipsawed particularly severely on the short-side by a quick shift in sentiment that causes previously weak stocks to suddenly rebound.

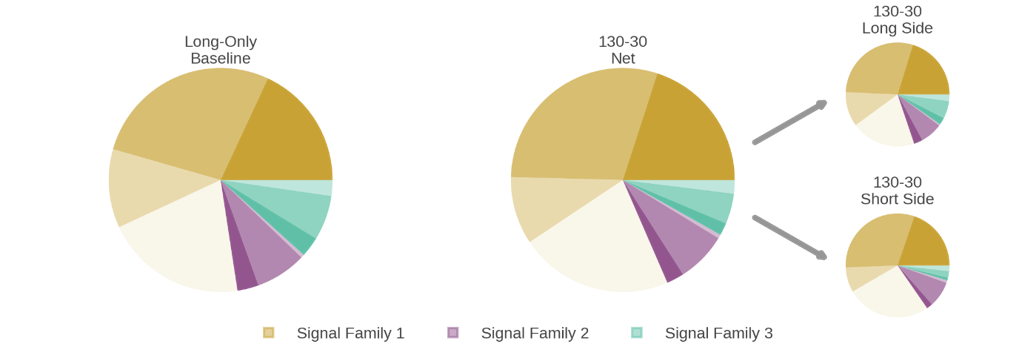

Several mechanisms can help to limit such vulnerability, however. A principal one is the maintenance of signal diversification on the short side of the portfolio to curb exposure to episodes like momentum crashes, junk rallies, or speculative froth that might drive asymmetric underperformance from one signal group. Indeed, in the case study, Figure 8 shows that the short-side of the hypothetical 130-30 is similarly well-balanced in terms of alpha drivers compared to both the extension’s long-side and the long-only baseline. Nuanced signal design can also mitigate the risk, for example by precisely isolating peer-relative stock mispricings and neutralizing unintended market or industry exposures that can exacerbate vulnerability to thematic market moves.8

Figure 8: Alpha Shares—Hypothetical Global 130-30 Strategy and Comparable Long-Only Baseline

A related concern associated with a breakdown of forecasting efficacy is crowding, i.e., this is the risk that a variety of seemingly unrelated signals might simultaneously and acutely underperform if many levered long-short systematic strategies concurrently unwind shared positions. During the 2007 “quant crisis,” in fact, struggles of many newly launched systematic 130-30 strategies were attributed to a wave of forced deleveraging by market-neutral quant funds.9

Nearly a generation later, however, conditions that prompted the quant crisis have changed a great deal. The marketplace is not now being inundated by a rush of rudimentary yet highly-levered long-short quant strategies nor is the ability to maintain a high degree of fund leverage taken for granted. Moreover, managers have developed mechanisms to mitigate crowding risk, including weighting signal exposures based on the health of the active opportunity set.

In the case of a shock to a risk factor, like size, our expectation of the performance impact on the hypothetical 130-30 strategy is anchored by the unlevered long-only baseline. That’s because in constructing both of these portfolios, we have imposed identical limits on many key risk exposures.

Nevertheless, an extension strategy that has been so specified still could be vulnerable to disproportionate underperformance if short-side risk is misestimated or crudely controlled. One illustrative example would involve a 130-30 strategy that has an overall portfolio beta of one but which is, nevertheless, unintentionally materially underweight the highest beta stocks. With such positioning, the extension could materially underperform in an intense speculative rally. Methods of mitigating such risk include applying nuanced measures of risk-factor exposures at the stock level and multifaceted controls on aggregate portfolio exposure. A second example would involve divergent performance of long and short holdings that normally provide naturally offsetting sensitivity to a risk factor. While imposing separate limits on long-side and short-side exposures represents one way to avoid such basis risk, managers have less restrictive options that may better maintain flexibility for alpha generation.

Conclusion

Systematic extension strategies are an underappreciated tool for asset owners seeking higher active returns. Relative to long-only portfolios, they can provide broader, deeper, and more precise exposure to a manager’s most attractive forecasts. While some investors have lingering concerns about risks associated with shorting, relaxing the long-only constraint increases flexibility in managing portfolio exposures. Moreover, relative to other approaches to high conviction active investing, which may rely on low-breadth bets, deliberately sacrifice diversification, or mask economic risk, systematic extensions are a highly disciplined approach to achieving the objective.

Endnotes

- While commonplace, the articulation of “relaxing the long-only constraint” is not strictly correct. To be precise, a conventional extension strategy replaces one portfolio construction constraint with another, i.e., in the case of 130-30, requiring that the portfolio be 130%-long and 30% short instead of 100%-long and 0%-short. For the purposes of this discussion, however, we assume that the manager has scanned a range of implementations, including long-only and various extension parameterizations, and determined that 130-30 is relatively attractive. This process would more closely approximate relaxation of the long-only constraint. Please contact us to discuss further.

- In any mathematical optimization, constraints may cause the global optimum to fall outside the set of feasible outcomes. If so, then one or more constraints typically “bind” at the best feasible solution (unless it is a local optimum in the interior of the restricted domain).

- It is conceivable that an extension could reduce breadth, perhaps if the short side of the portfolio represents a concentrated bet on one factor. In the case study that follows, however, we provide evidence that migration to the extension studied there preserves diversity of alpha drivers, and in the final section, we discuss measures to reduce crowding risk, which could conceivably induce a sudden loss of breadth.

- This levered baseline does not account for costs or frictions associated with leverage.

- While the baseline and the 130-30 share the general risk management framework, specific parameterizations of various risk controls will differ between the long-only and long-short implementation. Certain key points of departure are discussed in the next section.

- To do so successfully in the presence of real-world implementation costs and frictions puts a premium on nuanced liquidity, borrow cost, and market impact modeling in portfolio construction as well as attentive oversight of the portfolio on an ongoing basis.

- We do not discuss the case of a risk factor that is correlated with signal performance, because it can be viewed as a combination of exposures to an orthogonal risk factor and alpha signals.

- See Factor Investing: Is Keeping It Simple Shortsighted?, Acadian, February 2018.

- E.g., see Long/Short investing: Quant funds take shine off 130/30 performance, Euromoney, Nov 2, 2007.

Hypothetical

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, BrightSphere Investment Group Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.