Quick Take: Don't Blame the Quants this Time

That escalated quickly

-

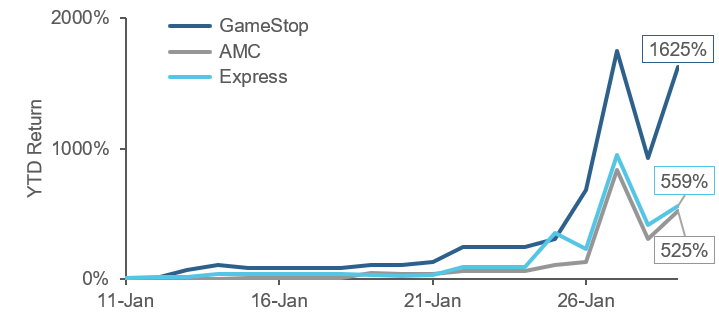

The spike in the stock price of video game retailer GameStop made for dramatic headlines last week, as journalists, politicians, and entertainers speculated on causes and implications of its 1600% year-to-date rise. (Below.) The company’s market capitalization has exploded from $1 billion to over $22 billion, larger than 40% of S&P 500 companies. Explosive gains in AMC and Express were similarly attributed to retail investors.

Impact appears severe, but narrow

-

The price action in these stocks has materially hurt a narrow set of hedge funds. To illustrate the potential damage, we estimate that a fund holding the most prevalent hedge fund longs and shorts (as reported by prime brokers) would have absorbed losses in excess of 30%, consistent with reported discretionary hedge fund performance in January.

-

A small set of shorts caused tremendous losses for some hedge funds, triggering broader liquidation of long positions as well as short covering in order to meet margin requirements. Prime brokers have reported record reductions in leverage and exposure. Nevertheless, overall gross exposure remains elevated, in fact, near peak levels.

-

Are hedge funds short all the same stocks? Not really. In fact, Acadian’s data shows that hedge fund long positions overlap each other significantly more so than shorts. Consistent with that asymmetry, hedge fund longs have lagged behind the market and fallen behind the short stock rally.

Quants appear largely uninvolved

-

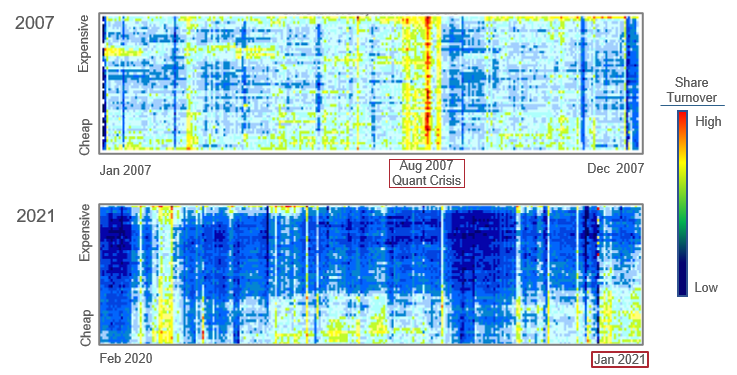

Some observers described last week as a fundamental version of the August 2007 quant crisis. Acadian’s “market sonar” shows no signs of systematic deleveraging of quant portfolios. For example, we don’t see unusually high volume in stocks that generic measures of value would identify as cheap or expensive. (Bottom chart.) More broadly, there are no signals of increased trading in generic factors that drove 2007’s tumult.

A speculative rise for a handful of retail investor-favored stocks

No evidence of systematic deleveraging- Share turnover by n-tile of generic value factor

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.