The Saylor-Buffett Ratio

Table of contents

How will we know when we’re in a speculative bubble? One approach is to look at the relative status of two men: Warren Buffett of Berkshire Hathaway and Michael Saylor of MicroStrategy.[1]

Buffett embodies traditional financial virtues: rational valuations, strong balance sheets, solid profits. At times of speculative excess, these virtues are unfashionable, and Buffett is said to have “lost his touch:”

December 1999, Barron’s: “Warren Buffett may be losing his magic touch.”[2]

May 2021, The Economist: “Suspicion is growing that Mr Buffett has lost his magic touch…”[3]

September 2024, The Economist: “Has Warren Buffett lost his touch?”[4]

This timeline suggests the following rule-of-thumb:

If Warren Buffett’s “lost his touch,” the market’s rising far too much.

On the other end of the spectrum is Saylor, a sort of bizarro-Buffett. MicroStrategy, like Berkshire, is unusual for a publicly traded company in that much of its value consists of its holdings of other assets. But while Berkshire owns boring old companies, MicroStrategy owns bitcoin. Saylor is an ardent bitcoin evangelist who has recently suggested that the price of bitcoin will rise from its current level of around $70K to $13M.[5] Here’s Saylor’s investment thesis as encapsulated in a 2020 tweet:[6]

Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

Like Buffett, Saylor has many fans. Here’s Jason Zweig of The Wall Street Journal:[7]

Many investors are convinced it’s worth paying far more for MicroStrategy’s stock than the value of its bitcoin would justify—because Saylor himself warrants what we might call a “genius premium.” He has, they believe, created a perpetual-motion money machine.

Back in the pre-bitcoin era, Saylor was an internet evangelist, and MicroStrategy embodied many elements of the tech stock bubble that peaked in March 2000 (Superbowl advertising in January 2000, vaulting ambitions, amazing stock price rise and fall, and an accounting scandal).

Buffett represents traditional business. Saylor represents futuristic visions. Buffett is folksy. Saylor is crypto-mystical. Buffett embraces the old. Saylor proclaims the new. Buffett is value and mean reversion. Saylor is momentum and exponential growth. Buffett is Apollo (order, logic, clarity). Saylor is Dionysus (liberation, imagination, infinity).

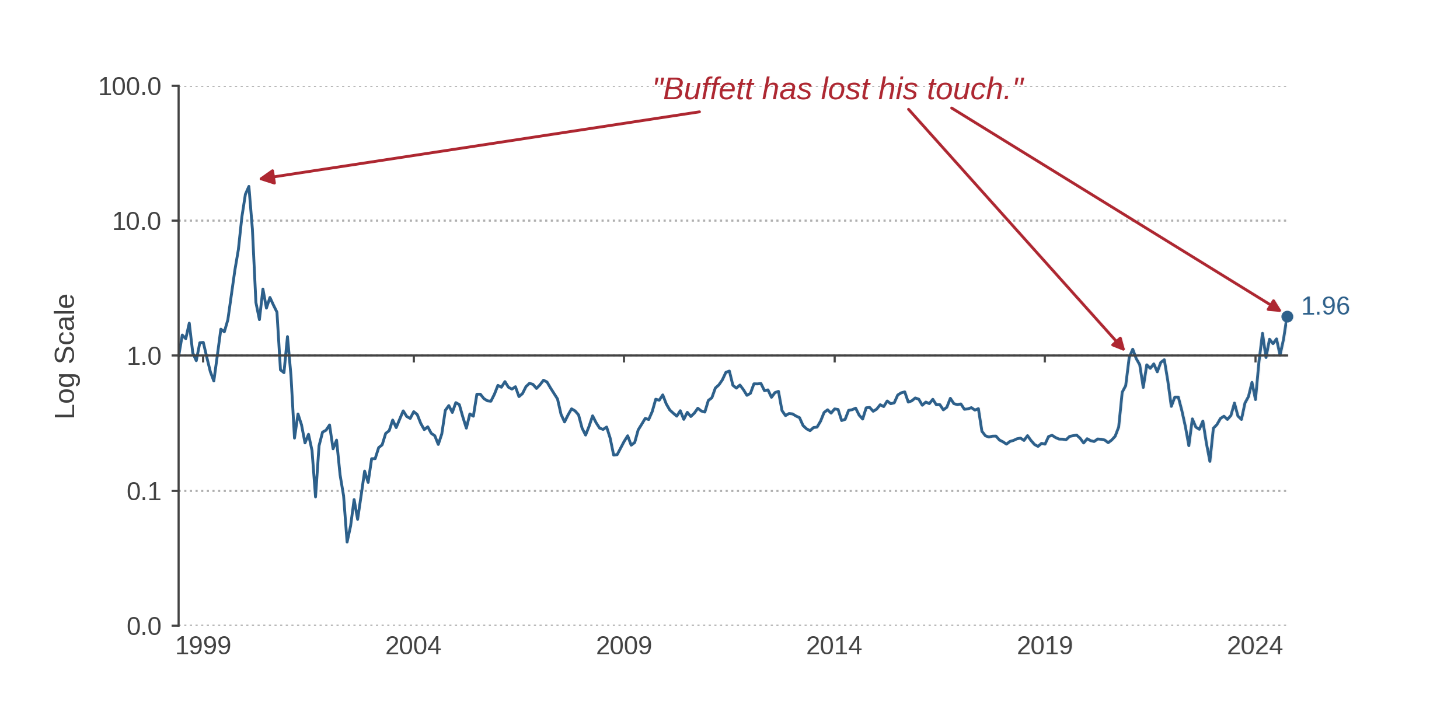

Let’s take a look at the Saylor-Buffett ratio, which I define as the total cumulative return on MicroStrategy divided by the total cumulative return on Berkshire Hathaway, with June 1998 = 1.

Figure 1: Saylor-Buffett Ratio

Ratio of cumulative returns of MicroStrategy / Berkshire Hathaway Class B, June 1998-Oct 2024

Source: Acadian.

Source: Acadian.

The ratio peaked around 18 in February 2000, then spent years below one until reaching parity again in the meme-stock craziness of January 2021. It then fell again as the bubble deflated in 2022. As of October 2024, the Saylor-Buffett ratio is at 2, a level it last touched on its way up in September 1999 and then on its way down in October 2000.

Now, the Saylor-Buffett ratio is just something I made up as opposed to a scientifically valid measure derived from first principles. But it sure looks like an accurate measure of speculative excess. Here we see yet another bubble indicator which says that conditions are not as extreme as March 2000 but are in the same ballpark as 2021.

Let me discuss three more aspects of the Saylor-Buffett dialectic: accounting standards, corporate issuance, and bitcoin.

Accounting standards

Buffett is “a champion of old-fashioned, straightforward accounting.”[8] Saylor, not so much. In its latest earnings report, MicroStrategy announced that it had achieved a “BTC yield” of 17.8% year-to-date. Now, a naïve English-speaking individual might assume that the word “yield” indicates that the firm generated a profit from its investments. Not so. Here’s MicroStrategy:

BTC Yield is a key performance indicator (“KPI”) that represents the % change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding … The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders … BTC Yield is not equivalent to “yield” in the traditional financial context.

Suppose for example that MicroStrategy buys bitcoin but does not change its shares outstanding. If it increases its total holdings of bitcoin by 5%, that will generate a “BTC yield” of 5%. Thus, according to MicroStrategy’s non-traditional approach to the English language, “yield” means “spending on bitcoin.” Welcome to the era of GOAP: Generally Orwellian Accounting Principles.

Corporate issuance

Buffett is an advocate of repurchases; Berkshire has repurchased many of its shares since 2018. In contrast, MicroStrategy has issued equity (as well as debt) to finance bitcoin purchases.

So Buffett has been giving money to shareholders, while Saylor has been taking money from shareholders. But at a conceptual level, you could argue that both men are responding rationally to prevailing market prices, and both are pursuing a “buy low, sell high” strategy.

Buffett perceived Berkshire to be underpriced, and thus bought low. As he said in the latest Berkshire shareholder letter:[9]

All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium.

In contrast, Saylor has issued equity, which would make sense if he believed that MicroStrategy was overpriced.

You could argue that as of November 2024, both men are acting as if the aggregate stock market level is too high. In the most recent quarter, Berkshire did zero repurchases (for the first time since 2018), has sold some of its equity holdings in other companies, and has built an enormous cash hoard of $325B. In contrast, MicroStrategy recently announced a plan to issue $21B more in equity (“we plan to use the additional capital to buy more bitcoin as a treasury reserve asset in a manner that will allow us to achieve higher BTC Yield”).

Issuance makes MicroStrategy larger, while repurchases make Berkshire smaller. Thus if you calculate the Saylor-Buffett ratio using market capitalization rather than cumulative returns, the ratio today stands at 5% (MicroStrategy has a market cap that is 5% as large as Berkshire), and we’ve already blown through the previous peak of 4% observed during the tech stock bubble. The market-cap-based version of the ratio is more extreme today because investors as a whole have been taking cash from Buffett and giving it to Saylor

Bitcoin

Here’s Buffett’s view of bitcoin as of May 2022:[10]

If you ... owned all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it, because what would I do with it? I’ll have to sell it back to you one way or another. It isn’t going to do anything.

Here is Saylor’s tweet in response to Buffett’s statement:[11]

#Bitcoin is hope for Berkshire Hathaway.

Um, okay.

One thing is for sure: in the period since this exchange in May 2022, MicroStrategy and bitcoin are both way up. In contrast to the $25 valuation mentioned by Buffett, the current market value of all bitcoin is over $1T, of which around 1% is owned by MicroStrategy.

Where is the market today?

If we look at the big picture, I’m not sure that we’ve reached extreme conditions just yet. Here’s what a full-blown bubble might look like:

- Accounting standards: More firms adopt novel accounting metrics or perhaps Orwellian accounting language.

- Net issuance: We see a massive wave of corporate issuance and reduction in repurchases. We see this now in Berkshire and MicroStrategy, but not yet in the U.S. stock market as a whole.

- Crypto bubble and AI bubble converge: I don’t know if we’re in an AI bubble, but it sure feels like we’re in a crypto bubble. Right now, we have two largely separate narrative streams: AI and crypto. If these two streams cross, it would be bad.[12]

The recent increase in the Saylor-Buffett ratio is one of the many small pieces of evidence (including increased ADR mispricing, history’s largest closed-end fund premium, and survey evidence on investor beliefs) that all seem to be pointing in the same direction: the market is getting frothy.

Endnotes

[1] References to this and other companies should not be interpreted as recommendations to buy or sell specific securities. Acadian and/or the author of this post may hold positions in one or more securities associated with these companies.

[2] “What’s Wrong, Warren,” Barron’s, December 27, 1999.

[3] “Warren Buffett should step aside for his chosen successor,” The Economist, May 8, 2021.

[4] “Has Warren Buffett lost his touch?” The Economist, September 3, 2024.

[5] “MicroStrategy’s Michael Saylor predicts bitcoin could hit $13 million by 2045,” CNBC, September 9, 2024.

[6] https://x.com/saylor/status/1307029562321231873

[7] “Can the Biggest Bet on Bitcoin Hold Up?” The Wall Street Journal, March 22, 2024.

[8] “Warren Buffett Minds the GAAP,” The Wall Street Journal, March 13, 2024.

[9] “Charlie Munger – The Architect of Berkshire Hathaway,” February 24, 2024

[10] “Warren Buffett wouldn’t buy ‘all of the bitcoin in the world’ for $25: ‘It doesn’t produce anything’” CNBC, May 2, 2022.

[11] https://x.com/saylor/status/1786528262786633993?lang=en

[12] “Try to imagine all life as you know it stopping instantaneously and every molecule in your body exploding at the speed of light.” Consequences of crossing the streams as described in Ghostbusters, 1984.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.