Systematic Active: Indispensable Toolkit for EM Investing

Key Takeaways

- Investors have many choices to make in crafting their allocations to Emerging Market (EM) equities. In this note we make the case for taking a systematic active approach.

- An active stance is especially compelling in EM, where inefficiency creates a reservoir of opportunity for stock selection.

- In harvesting the mispricings, systematic methods offer enduring efficacy, precise risk control, and the scalability necessary to exploit the most distinctive and inefficient segments of emerging markets.

Table of contents

Emerging market (EM) equity investors have many decisions to make in crafting their allocations: active or passive, diversified or concentrated, discretionary or systematic? In this note we make the case for a systematic active approach.1

We first present compelling evidence to go active. Emerging markets are inefficiently priced, which provides a reservoir of mispricings that allows active managers to thrive. Next, we argue for systematic approaches to active EM investing based on the enduring efficacy of their forecasting signals and advantages in risk control. Finally, we urge systematic active investors to embrace an expansive investment universe in EM, one that leans into the most distinctive and inefficient segments of these markets, including small caps.

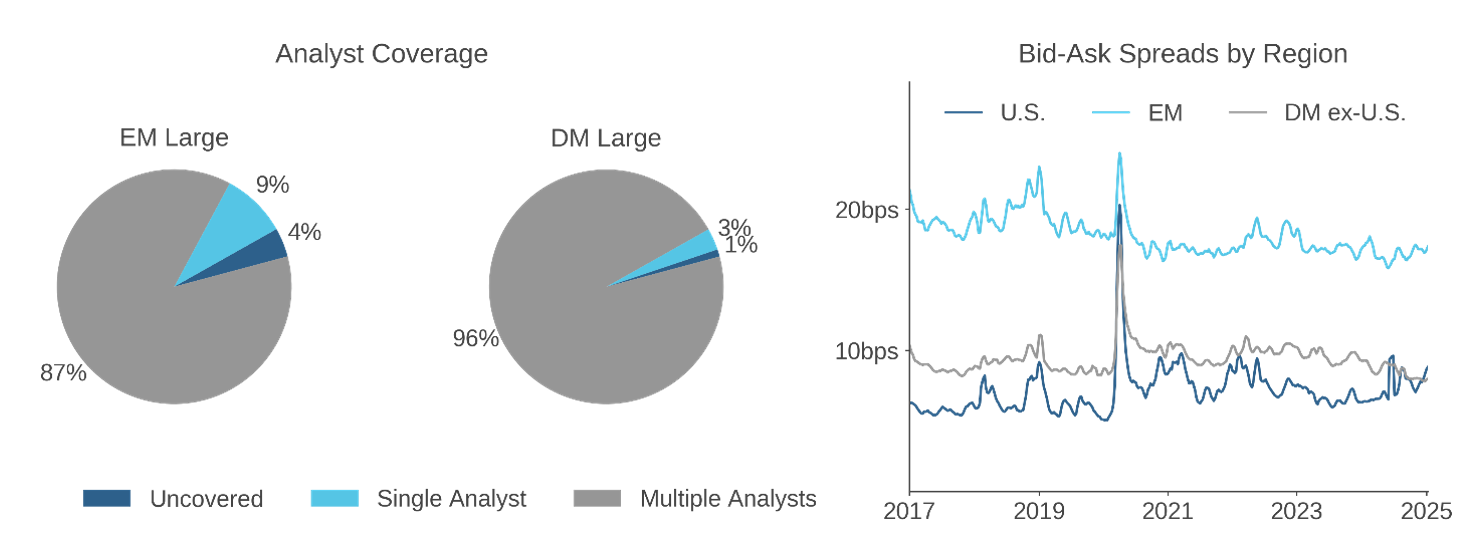

Choose Active

In EM equities, active is the most natural investing posture. The primary reason is that the inefficiency of these markets offers terrific opportunity for stock selection. Figure 1 documents origins of this inefficiency. Compared to developed markets, the information environment in EM is poor, as evidenced in the left panel by analyst coverage for large caps. (See Figure 6 for small caps.) Trading conditions are also more challenging, as measured in the right panel by bid-ask spreads. Together, these characteristics foster stock-level mispricings that persist long enough for active managers with skilled implementation to exploit.

Figure 1: Roots of Inefficiency in EM—Information Environment and Trading Conditions

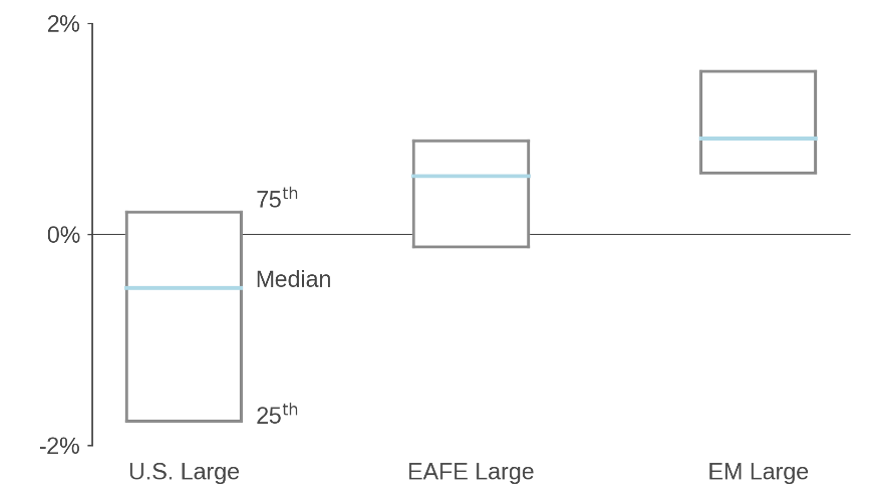

The benefit for investors is evident in Figure 2, which compares active managers’ performance across regions over roughly the past decade. In EM, even a lower quartile (25th percentile) active strategy generated positive active returns, higher than in EAFE and in sharp contrast to managers’ struggles in the U.S.

Figure 2: Large-Cap Active Manager Returns by Region

Average annualized gross-of-fee active returns, Sep 2014-Sep 2024. Strategies in eVestment U.S., EAFE, EM large-cap universes.

Another more subtle reason to opt active in EM is that choosing passive may not provide the simplicity and transparency that asset owners anticipate. That’s in part because EM benchmark indexes are themselves active constructs. Their sponsors disagree as to which countries are emerging and which stocks to include and at what weight, and in EM these decisions have first-order consequences for index composition and characteristics.2 For this and other reasons, going passive in EM is unlikely to be a “set and forget” path.

Choose Systematic

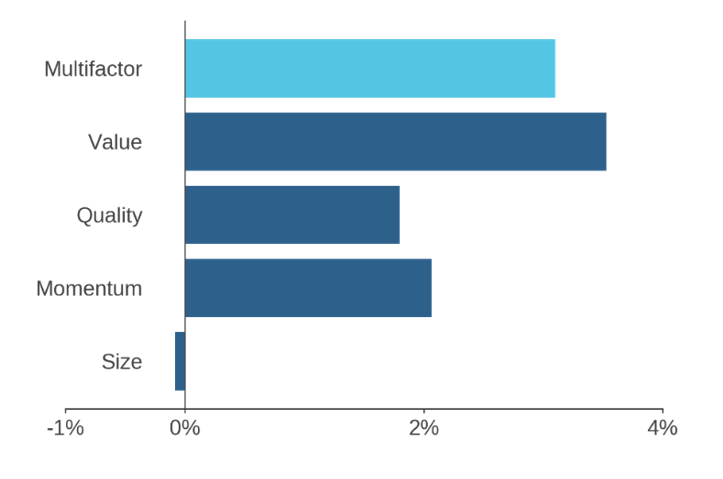

The archetypal systematic stock selection model is designed to capture return premia that arise from investors’ incomplete information, perceptual biases, and irrational behaviors. In EM, signals based on such phenomena, including fundamental- and sentiment-based predictors, have demonstrated robust efficacy. Figure 3 provides one transparent, arms-length metric. MSCI’s EM value-, quality-, and momentum-based factor indexes have outperformed the standard benchmark, as has a multifactor blend.3 Moreover, these indexes represent only rudimentary implementations of commoditized signals applied in the mid-to-large-cap segment of EM, and more sophisticated systematic signals exhibit superior efficacy, as we have discussed in prior research.4 In addition, the potential for systematic alpha generation is also greater among small-cap EM stocks, as we show in the next section.

Figure 3: Long-Term Performance of Systematic Signals in EM

Annualized MSCI EM factor index active returns versus cap-weighted benchmark, 2000-2024.

There is also a compelling case for systematic investing in EM based on its advantages in risk control. An intuitive motivation comes from our prior research on geopolitical event risk.5 Local geopolitical shocks, including civil disruptions, coups, assassinations, and natural disasters, are unfortunately common in emerging countries, and EM investors would be wise to control exposure to such events through prudent geographic diversification.

Systematic portfolio construction methods are particularly well equipped to provide it. They explicitly optimize tradeoffs between expected portfolio return and risk, a process that causes them to diversify uncompensated risks, geographic and otherwise. Moreover, in doing so, the scalable methods permit the efficient exploitation of the entire investment universe. Systematic portfolio construction also offers a ready framework in which to explicitly limit portfolio exposure to myriad sources of risk, and managers have enormous flexibility in configuring these controls to suit both market context and investors’ tolerances.

In contrast, one of the most popular forms of EM investing, macro-thematic, explicitly rejects diversification and embraces concentrated risk. Over the years, a host of narrow EM investing themes have come and gone, including the BRICS, Fragile Five, Next Eleven, and the BATX.6 Figure 4 illustrates the risks of herding into such themes. Investors who mistimed the startling BATX rally would have been crushed by the Chinese regulatory crackdown on large platform companies in late 2020.7 Beyond anecdote, academic research has provided rigorous evidence of the risks of performance chasing. For example, investors make ill-timed allocation decisions by overreacting to what they see in the rear-view mirror.8 As a result, we view thematic investing in EM (and elsewhere) as more likely to fall victim to hindsight bias and other behavioral mistakes rather than to produce enduring success.

Figure 4: Risks of Thematic EM Investing—Case of the BATX

More broadly, the heuristic portfolio construction methods that typify discretionary strategies pose other drawbacks in diversification. Often risk managed to just a few broad portfolio characteristics and lacking the scalability to effectively employ a broad investment universe, we expect them to manifest unintended risk exposures, style drift, as well as suboptimal trade-offs among known return premia.9 By comparison, the advantages of systematic portfolio construction in controlling risk are clear.

Embrace an Expansive Investment Universe

In their active EM equity allocations, we would encourage asset owners to embrace an expansive investment universe. One reason is that as global financial markets became increasingly integrated over recent decades, emerging markets lost some of the distinctiveness that merited their treatment as a separate asset class. Figure 5 quantifies the change, showing that the fraction of variation in EM stock returns explainable by global risk factors increased over the past 25 years.10 To push back against that trend, active EM investors would be wise to emphasize segments of EM that retain greater “local” flavor rather than, say, focusing on the largest, globalized firms that dominate the conventional EM benchmark.11

Figure 5: The Global Integration of Emerging Markets

Adjusted R2s from rolling regressions of hypothetical EM cap-quintile portfolio returns on global risk factor returns.

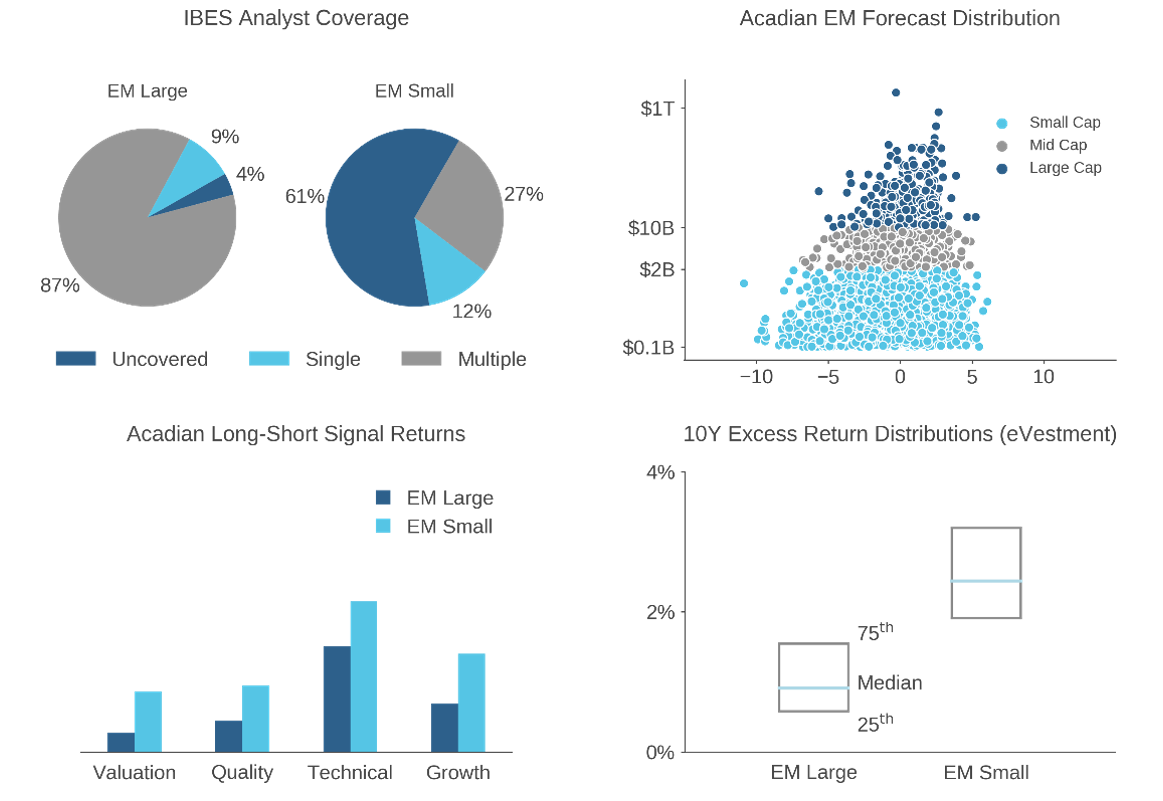

Figure 6: The Appeal of EM Small-Caps for Systematic Active Strategies

One way to do so is by embracing EM small caps, which remain less-well integrated with global equity markets, as evident in Figure 5. Figure 6 shows the benefit, tracing out a chain of evidence that EM small caps offer an especially attractive environment for stock selection, specifically via systematic methods:

Upper-left: The EM small-cap information environment is comparatively poor, as exemplified by analyst coverage.

Upper-right: That inferior information environment translates into greater pricing inefficiency. Greater dispersion in our proprietary alpha forecasts among small caps versus mid and large (compare the light-blue to the grey and dark-blue dots), indicates that small caps offer the most under- and over-priced stocks, seen through the lens of our forecasting models.

Lower-right: Consistent with the relative richness of that ex ante opportunity set, active managers have enjoyed greater success in EM small caps than in large, …

Lower-left: … and our proprietary systematic forecasting signals, specifically, exhibit relatively strong ex post efficacy among EM small caps.

In addition to embracing small caps, asset owners ought to weigh distinctiveness when choosing which markets to include in their EM investment universes. Within China, for example, A-shares stand out in terms of their “local character,” making the enormous and liquid onshore market an intriguing reservoir of stock-selection opportunity that may warrant emphasis relative to China’s offshore stocks, which are highly integrated with global markets.12 In EM ex-China, investors with the flexibility to do so might even consider opportunistically expanding their EM investment universes to include less-well-integrated slices of developed markets.13

Yet some asset owners reject an expansive EM investment universe out of discomfort with perceived risks, both financial and headline-related, of holding broad portfolios that include many small and unfamiliar companies. In the context of a systematic investing process, however, that reluctance is usually misguided for several reasons.

First, some such concerns are misplaced. For example, even though individual EM small-cap stocks tend to exhibit somewhat higher volatility than larger caps, a greater proportion of it is diversifiable in portfolio construction.14 Second, as discussed in the prior section, systematic methods are well designed to manage incremental risks. For example, they can limit exposure to individual issuers or groups thereof. Moreover, while in a long-only context, leaning into small-cap stocks necessarily entails exposure to a size risk factor, systematic portfolio construction affords flexibility and precision in controlling it. Finally, with respect to reputational risk, the analytical toolkit of systematic investing provides some broadly overlooked remedies. For example, we can apply natural language processing to identify emerging risk themes and to flag specific companies associated with them.

In fact, the instinct to restrict the EM investment universe is antithetical to the conceptual foundation of systematic investing, which is designed to exploit “breadth.” The idea is that the scalability of the systematic process increase portfolio risk-adjusted returns through application of the manager’s forecasting skill across a large number of independent “bets” without any weakening of model conviction.15 In the systematic investing context, therefore, we would expect limiting breadth to have a cost in terms of performance, which would manifest in lower expected returns or higher expected risk.16

Conclusion

The inefficiency of emerging markets offers fertile ground for stock selection, especially for asset owners willing to embrace an expansive investment universe. In making the best use of this opportunity set, a systematic approach offers a distinct edge, offering a unique blend of nuance and scalability in forecasting, portfolio construction and risk management. Together, these traits identify systematic active as a compelling approach to EM investing.

Endnotes

- Making the case for allocating to emerging market equities in the first place is beyond the scope of this note. Yet we believe that it is compelling. To start with, EM stocks account for nearly 40% of the world’s tradable listings by count and 10% of global market cap. It would take a strong belief that the market is mispricing the relative outlook for EM stocks to warrant their omission or significant underweight in a total market portfolio. For discussion of such themes, see Reassessing Emerging Markets Equities, Acadian, October 2020.

- For example, MSCI and FTSE disagree as to whether Korea is now developed, a decision that affects 10% of the MSCI EM Index. In addition, while the MSCI EM Index includes A-shares from China’s large onshore market, it imposes an 80% haircut on their cap weights, slashing their representation from about 17% to 4%. For further discussion regarding the character of EM benchmarks, see Reflections on the Ukraine Crisis: Watershed for EM Investing?, Acadian, July 2022.

- MSCI’s multifactor index also includes size. Consistent with Acadian’s view that size exposure is not compensated risk, the MSCI EM Size Factor Index has generated negligible active returns over the period, as indicated in Figure 3.

- E.g., see Factor Investing: Is Keeping It Simple shortsighted?, Acadian, February 2018, Growth Versus Value: End of an Era?, Acadian, November 2022, and Acadian’s Approach to Value Investing, November 2019. For discussion of the management of generic factor exposures in a sophisticated systematic process, see Generic Exposures: Not All Gold Glitters, Acadian, September 2024.

- In a proprietary study of geopolitical shocks from 1919-2015, we found that approximately 70% of the events occurred outside of developed markets, likely an understatement of the true proportion due to sources used and data restrictions on the sample. See Geopolitical Shocks: What to Expect from the Unexpected, Acadian, Acadian, July 2017.

- BATX refers to Alibaba, Baidu, Tencent, and Xiaomi. References to these and any other companies in this paper should not be interpreted as recommendations to buy or sell specific securities. Acadian and/or the authors of this paper may hold positions in one or more securities associated with these companies.

- For more discussion of thematic investing in EM, see Rising Tiger, Falling Dragon: Theme Du Jour in EM Equity Investing, Acadian, May 2024.

- E.g., see Ang, Goyal, and Ilmanen (2014).

- We documented such symptoms of heuristic portfolio construction in a broad empirical study of concentrated U.S. equity strategies. See Concentrated Equity: Practice Versus Premise, Acadian, October 2024.

- This approach resembles one described by Pukthuananthong and Roll (2009).

- For discussion of local stocks, see Eun, Kim, Wei, and Zhang (2017).

- This observation has relevance even for investors looking to limit their overall China exposure, because it suggests a prioritization in deallocation.

- For in-depth discussion of these and other issues related to China and EM ex-China allocations, see Polarizing Views: China’s Impact on EM Investing, Acadian, December 2021.

- While the median stock in MSCI’s EM Small Cap Index has exhibited 15-20% higher volatility than the median stock in its larger cap cousin, the MSCI EM Small Cap Index's volatility has been closer to that of MSCI’s standard EM benchmark.

- This is the intuition behind Grinold and Kahn’s Fundamental Law of Active Management. Please contact us to discuss further.

- For discussion of the costs of limiting holdings in a systematic portfolio, see Conviction, Concentration, and Quant, Acadian, July 2015.

eVestment Disclaimer

eVestment Alliance, LLC, and its affiliated entities (collectively, eVestment”) collect information directly from investment management firms and other sources believed to be reliable, however, eVestment does not guarantee or warrant the accuracy, timeliness, or completeness of the information provided and is not responsible for any errors or omissions. Performance results may be provided with additional disclosures available on eVestment’s systems and other important considerations such as fees that may be applicable. Not for general distribution and limited distribution may only be made pursuant to client’s agreement terms. All managers in an eVestment category are not necessarily included. Copyright 2012-2025 eVestment Alliance, LLC. All Rights Reserved.

Hypothetical Legal Disclaimer

Acadian is providing hypothetical performance information for your review as we believe you have access to resources to independently analyze this information and have the financial expertise to understand the risks and limitations of the presentation of hypothetical performance. Please immediately advise if that is not the case.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.