Don’t swim naked: Low risk strategies in a risk-loving market

Table of contents

As Warren Buffett says, you only learn who’s been swimming naked when the tide goes out. Right now, the tide is high for the S&P 500, which has dominated global markets in the last five years. Anything that is not the S&P 500 has disappointed, including diversifying equity strategies such as small caps, non-U.S., or low volatility.

Many asset allocators have decided that now is the time to swim naked. They have flung off the bothersome bathing suit of diversification, deciding to go all in on U.S. large caps. Is that a smart move?

I don’t think so. Here are the conditions under which it makes sense to abandon diversifying strategies:

- You love to gamble and don’t care about potential drawdowns.

- You possess magical market timing abilities, and you are sure that the next five years will be the same as the last five years.

- You are a fanatical believer in the Capital Asset Pricing Model (CAPM), but only for U.S. stocks.

Otherwise, the prudent decision is to diversify across asset classes, geographies, and strategies.

The Glorification of Risk

Do you love risk? If so, here’s what I recommend, in increasing order of recklessness:

American isolationism. Put 100% of your wealth in large-cap U.S. stocks.

Concentrate. Why buy many boring stocks when you can buy a handful of exciting stocks that only go up?

Lever. Why invest 100% of your wealth in equites when you can invest 200% by borrowing?

Get creative. Why not go hog wild on risky instruments?

- Put all your wealth in levered single-stock ETFs.[1]

- Put all your wealth in call options on levered single-stock ETFs.

Now, I’m not saying that calls on levered single-stock ETFs are inherently evil or stupid. What I’m saying is that they are similar to lottery tickets: fun, maybe, but not desirable in a portfolio designed for long-term wealth maximization.

If you don’t love risk, I recommend a different approach:

Diversify.

Underweight volatile assets.

Use leverage responsibly. For example, invest in risk-managed extension strategies, not in wild speculative bets on single names.

As of 2024, we live in a risk-loving market. Let me discuss just one manifestation: the case of the 25-year-old trader who doubled his parents’ retirement assets, as described in The Wall Street Journal.[2] How did he do it? By piling leverage atop leverage atop volatility.

Here’s the recipe. First, start with bitcoin. Bitcoin is already a speculative asset with a trailing volatility of 55%.

Second, mix in MicroStrategy.[3] The Journal quotes Michael Saylor of MicroStrategy as saying:

The way that we outperform bitcoin, in essence, is we just lever up bitcoin.

Thanks to this leverage, MicroStrategy stock has a trailing volatility of 120%. Not a problem, according to Saylor:

When you embrace volatility, then you’re outperforming the S&P.

But if you want to embrace volatility twice as hard, you need a 2X levered single-stock ETF for MicroStrategy, which the 25-year-old says is part of a “less dangerous and smarter” portfolio for his parents. This ETF has a trailing volatility of 232%, thus it has quadruple the volatility of bitcoin alone.

A market where risk-takers are valorized, and safety is despised, is a speculative market. As I’ve previously said, in bubbles we generally see risky stocks go up more than safe stocks as the bubble expands.

The flows into leveraged single-stock ETFs in a raging bull market are reminiscent of the bubble of the 1920s. As I’ve previously discussed, we saw similar financial dynamics involving leverage and pyramidal closed end funds in 1929. Here’s Galbraith (2009):

By the summer of 1929, one no longer spoke of investment trusts as such. One referred to high-leverage trusts, low-leverage trusts, or trusts without any leverage at all.

Similarly, as of November 2024, we can no longer speak of ETFs as such. We must speak of 2X leveraged ETFs on firms making levered bets on cryptocurrency. Sign of the times.

If you are the type of person that would entrust your life savings to a 25-year-old, then by all means, give up on international diversification, throw in the towel on small caps, and abandon low-volatility strategies.

If you are not that type of person, then this is no time to go wobbly.

The CAPM: A Rational Model that Only Works in Irrational Times?

Let’s discuss a particular diversifying strategy: low-volatility equities, also known as minimum vol, managed vol, low beta, or defensive equity. In the past five years in the U.S., this strategy has not kept pace with the overall market. Another way of saying the same thing: in the past five years, the Capital Asset Pricing Model (CAPM) has worked great.

Here’s the basic implication of the CAPM: the market has the highest possible Sharpe ratio out of all portfolios you might construct. As a matter of math, this statement implies that stocks with higher betas have higher average returns. I won’t attempt to explain this idea further, you’ll just have to trust me about the math. I’ve spent many years of my life trying to explain the CAPM to students. Most start out hating the CAPM, and then after I have carefully explained it to them (using words, equations, and graphs), they hate it even more. They feel it is confusing, irrelevant, and untrue.

The CAPM is indeed untrue, but it is not irrelevant. The empirical failure of the CAPM implies that we can construct an attractive strategy: buy low-risk stocks.

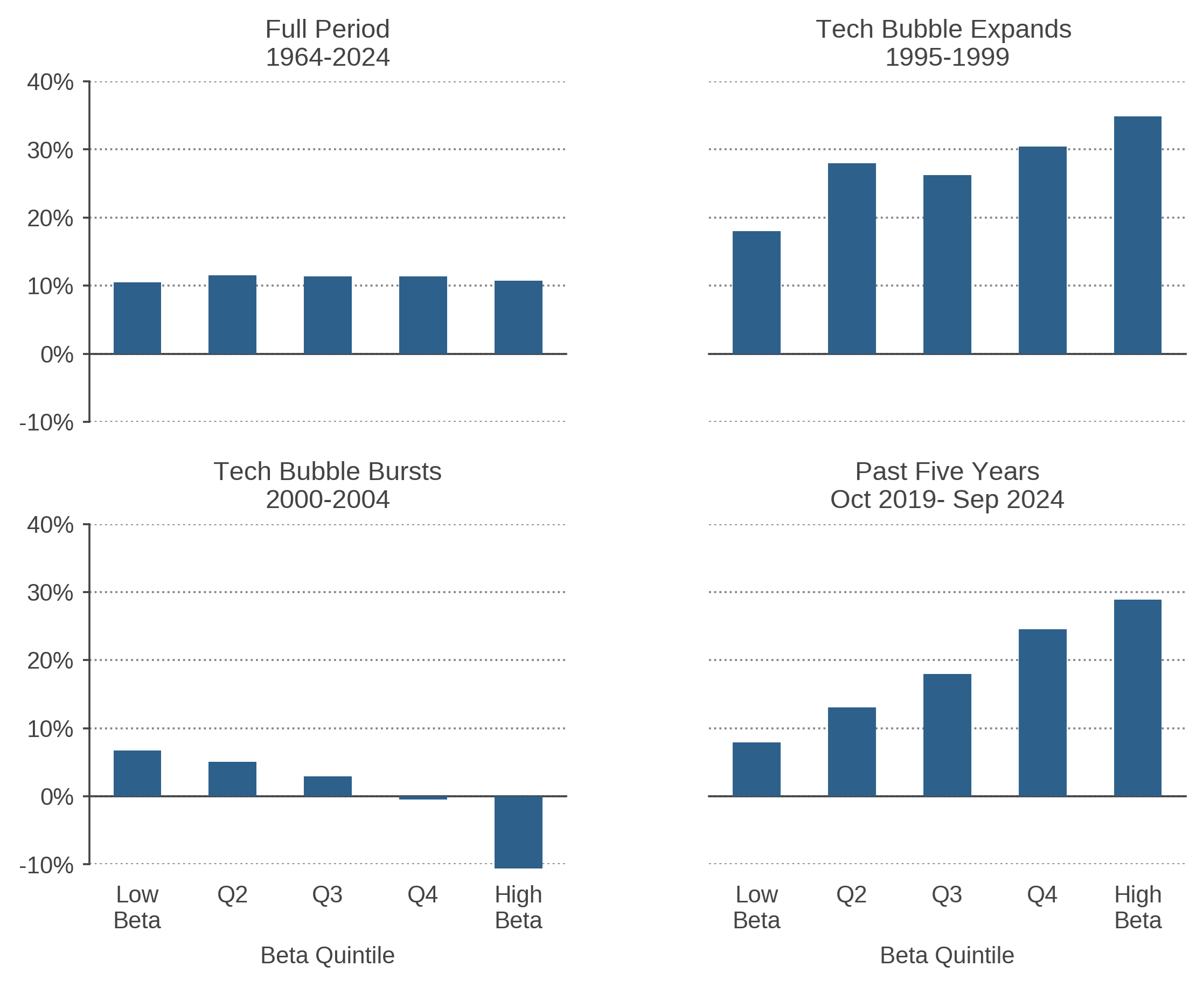

Consider Figure 1, which uses U.S. equity data from Professor Ken French. It shows annualized geometric average returns on different portfolios of U.S. equities. The CAPM implies that over long periods, high-risk stocks (as measured by market beta) will have high returns, and low-risk stocks will have low returns. The upper left panel of Figure 1 shows that this prediction is false: if you sort stocks by prior beta over the period from 1964 to today, there’s only a tiny difference in the returns of safe stocks vs. risky stocks. The relation between beta and average return is pretty much flat as a pancake. Another way to describe this result: “the security market line is too flat.”

Figure 1: Average Returns by Market Beta Quintile, U.S. Equities

This failure of the CAPM has been known for many decades and is documented in Black, Jensen and Scholes (1972), Fama and French (2004), Baker, Bradley, and Wurgler (2011), Frazzini and Pedersen (2014), and Acadian (2024). See those papers for formal tests of the CAPM; here, I’m just going to informally discuss the evidence.

The practical implication of Figure 1’s flat pattern is that you should put your money in the lower quintiles, that is, overweight safe stocks and underweight risky stocks. The reason is that as you go to the right, volatility goes up, raising the chance of drawdowns and wealth reduction.

Investors often have the intuition that “on average, stock prices go up 10% a year, therefore I should own high beta stocks, because they will go up even more.” No. On average from 1962 to 2024, the market went up more than 10% a year, but high-beta stocks did not go up even more. So if you expect next year to be a typical year of rising stock prices, that doesn’t mean high risk is good.

Now, there’s one type of market where high risk actually is good: markets gripped by irrational exuberance. The upper right panel of Figure 1 shows the five-year period ending in December 1999 (the tech-stock bubble). Let us take a minute to marvel at these numbers. First, consider the height of the bars: all types of stocks went up a lot, from 18% (lowest-beta quintile) to 35% (highest-beta quintile). Those are big annual returns; the stock market tripled in this period. Second, the bars generally get higher as we go from left to right. So, you can see that the tech-stock bubble was very different from the full 1964-2024 sample period, because as the bubble was inflating, the CAPM worked.

Now consider the past five years, shown in the lower right panel. The past five years have been a triumph for the CAPM. So we’ve just lived through a period similar to the tech stock bubble, when very risky stocks did great.

Now, I don’t want to overstate the CAPM’s recent triumph. First, the CAPM has worked less well in U.S. small caps and worked not at all in emerging markets (see Acadian (2024)). Second, other systematic equity strategies have worked great, especially outside the U.S. And even within the U.S., some strategies (such as quality/profitability) have beaten the market on a risk/reward basis. So, contrary to the CAPM’s predictions, it’s been possible to construct a portfolio that is superior to the market from 2019 to 2024.

We can use the lower right panel to interpret recent events. The Magnificent Seven? They are not in the leftmost quintiles; no surprise they are doing well. MicroStrategy? It’s got a beta of three, so it’s riding high in quintile 5. Here, I’m not making a statement about causality, I’m just saying that the CAPM’s predictions are consistent with dramatic market phenomena in recent years.

What happens when bubbles deflate? That’s when high risk brings high pain instead of high reward. The lower left panel shows the period after the tech-stock bubble, namely the five years ending in December 2004. In this phase of U.S. equity history, the risk-lovers were humbled, and the risk-haters were victorious, with the safest stocks delivering 7% annual returns and the riskiest stocks delivering -11%. Losing eleven percent a year over five years: ouch.

Now, it’s no surprise that the bubble inflation period of 1995-1999 was followed by the bubble deflation period of 2000-2004. Bubbles eventually burst. We also know that the whole 1964-2024 sample produces a flat pattern, so any good periods for high risk stocks must be cancelled out by bad periods. The main point is that over sixty years, the bars are all the same height. High risk, no reward.

Looking ahead, I don’t know what the future will bring. But I do know that the past five years have been atypical.

One last word about the CAPM. If you truly believe it, you should be holding the whole world market using market-capitalization weights, not just U.S. stocks and not just the S&P 500. Now, I don’t believe in the CAPM, but I do believe (as I’ve previously mentioned) that market-cap weights should be the starting point for any asset allocation exercise. International diversification makes sense.

The Tide is High, but I’m Holding On

Look, I own a house. Every year I pay the insurance company a large sum of money for property insurance. I also have many smoke detectors, which occasionally go off in the middle of the night for no reason. It’s a huge pain.

However, in the past five years, not once has my house caught on fire, not even slightly. Is the right response to get rid of my smoke detectors? Tell the insurance company to get lost? Start smoking cigarettes in bed? No! These are not the optimal responses to five years of flameless living. I have insurance because I don’t know what will happen in the next five years, not because of what did or didn’t happen in the trailing five years.

When it comes to the stock market, what will the next five years bring? Let me sketch out three scenarios and map them into Figure 1.

AI Nirvana. The stock market doubles or triples. Right-hand panels of Figure 1.

AI Disaster. Due to self-fulfilling fears of AI-caused unemployment, we have the Great Depression II, with the world economy collapsing. Lower left panel in Figure 1.

Something else.

So, looking at Figure 1, we get to allocate our money across the five quintiles, while the universe decides which panel will occur. When the tide is high, we get the rightmost panels. Risk on. When the tide is low, we get the lower left panel. Risk off. Unlike real tides, the stock market tide is unpredictable, and we don’t know which panel we’ll get. That’s why the lower quintiles of Figure 1 are a safe place to be.

You should never go skinny dipping in the ocean of risk. We live in an uncertain world, and when the tide rolls out, it’s better to be overdressed than underdressed.

Endnotes

[1] “Gamblers Are Sinking Billions Into a Leveraged Market Fringe,” Bloomberg, November 22, 2024.

[2] “What’s Flying Higher Than Bitcoin? The Software Company Buying Up Bitcoin,” The Wall Street Journal, November 25, 2024.

[3] References to this and other companies should not be interpreted as recommendations to buy or sell specific securities. Acadian and/or the author of this post may hold positions in one or more securities associated with these companies.

References

Acadian Asset Management, “Low-Volatility Investing: Welcoming the Elephant into the Room,” February 2024.

Baker, Malcolm, Brendan Bradley, and Jeffrey Wurgler. "Benchmarks as limits to arbitrage: Understanding the low-volatility anomaly." Financial Analysts Journal 67, no. 1 (2011): 40-54.

Black, Fischer, Michael C. Jensen and Myron Scholes. “The Capital Asset Pricing Model: Some Empirical Tests,” in Studies in the Theory of Capital Markets. Michael C. Jensen, ed. New York: Praeger, pp. 79 –121 (1972).

Fama, Eugene F., and Kenneth R. French. "The capital asset pricing model: Theory and evidence." Journal of Economic Perspectives 18, no. 3 (2004): 25-46.

Frazzini, Andrea, and Lasse Heje Pedersen. "Betting against beta." Journal of Financial Economics 111, no. 1 (2014): 1-25.

Galbraith, John Kenneth. The Great Crash 1929. Houghton Mifflin Harcourt, 2009.

Legal Disclaimer

These materials provided herein may contain material, non-public information within the meaning of the United States Federal Securities Laws with respect to Acadian Asset Management LLC, Acadian Asset Management Inc. and/or their respective subsidiaries and affiliated entities. The recipient of these materials agrees that it will not use any confidential information that may be contained herein to execute or recommend transactions in securities. The recipient further acknowledges that it is aware that United States Federal and State securities laws prohibit any person or entity who has material, non-public information about a publicly-traded company from purchasing or selling securities of such company, or from communicating such information to any other person or entity under circumstances in which it is reasonably foreseeable that such person or entity is likely to sell or purchase such securities.

Acadian provides this material as a general overview of the firm, our processes and our investment capabilities. It has been provided for informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in investments that may be referred to herein and must not be construed as investment or financial product advice. Acadian has not considered any reader's financial situation, objective or needs in providing the relevant information.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore. It is also registered as an investment adviser with the U.S. Securities and Exchange Commission.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 ("AFSL"). It is also registered as an investment adviser with the U.S. Securities and Exchange Commission. Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority ('the FCA') and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive, or to Qualified Investors in Switzerland as defined in the Collective Investment Schemes Act, as applicable.

Don't miss the next Acadian Insight

Get our latest thought leadership delivered to your inbox